Blog

Millions Lost, Data Exposed: The Growing Threat on Financial Institutions

March 19, 2024

By Orly Koren

Cyberattacks are on the rise in the financial sector, causing significant financial losses and disruption. According to the IBM Cost of a Data Breach Report 2023, the financial sector rank second, only behind healthcare, in cyber incident damage. The average cost per attack for financial organizations is a staggering $5.9 million, exceeding the global average of $4.45 million.

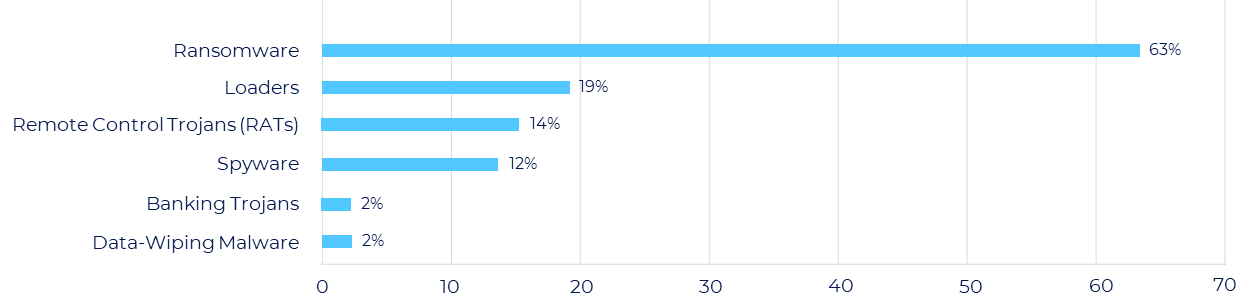

The Threat of Ransomware

Globally, ransomware is the leading culprit behind financial service disruptions. This malicious software encrypts data, essentially holding it hostage until a ransom is paid to regain access.

Types of malwares in successful attacks on financial institutions (Q1–Q3 2023)

Source: Positive Technologies

On May 2023, a high-profile attack involved LockBit, a ransomware group, targeted BSI, a major Indonesian bank. The attack disrupted BSI’s branches operations and ATMs, with attackers demanding $20 million ransom. When the bank refused, they leaked a massive 1.5 TB of confidential data online.

CNA Financial Corp., a leading U.S. insurance company, paid a $40 million ransom in March 2021 to regain control of its network after a ransomware attack that encrypted its systems and compromised its data.

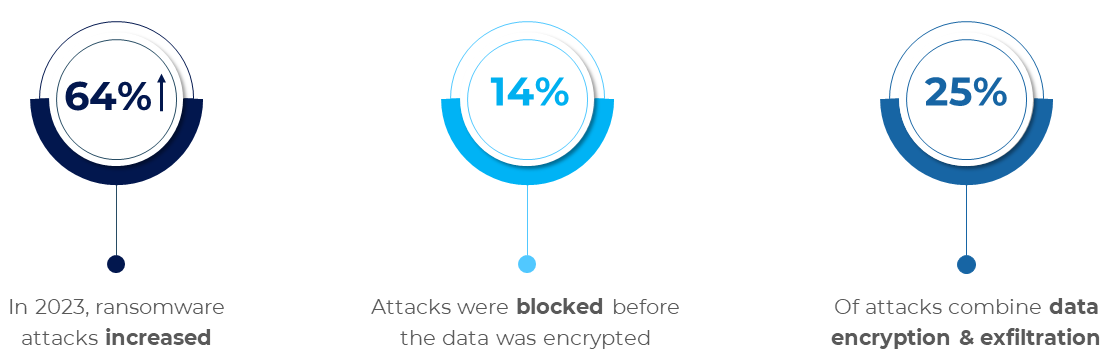

Key figures about ransomware in Financial Institutions

Source: Sophos

Beyond the Financial Toll: Disruption to Business Operations & Reputational Damages

The damage caused by cyberattacks goes far beyond immediate financial losses. Disruptions to services, delayed transactions, and locked-down operations can cripple a financial institution. The more critical the system attacked, the greater the operational cost.

But the impact goes deeper. Breaches cast doubt on the organization’s ability to safeguard sensitive information, potentially leading to customer churn. Negative media coverage further amplifies the damage, jeopardizing stakeholder confidence and market sentiment.

The value of customer trust is immeasurable. A tarnished reputation can have a long-term impact on brand value, market share, and even stock prices for publicly traded companies.

Building Cyber Resilience

Building cyber resilience is crucial for financial institutions to mitigate these risks. RayzSecurity, Rayzone Group’s cybersecurity division, offers a unique comprehensive Red Team exercise that simulates real-world attacks, assessing the digital security posture and mitigate vulnerabilities.

This exercise provides valuable insights and actionable recommendations for immediate remediation and long-term prevention. We are committed to helping organizations implement best practices and build a robust security posture to safeguard their institution, data, and customers.

Contact us today at info@rayzoneg.com and learn more about our Red Team exercise and how it can safeguard your financial institution.

More Insightful Reads…

May 2, 2024

Safeguarding Critical Water Infrastructure: A Collaborative Breakthrough

Critifence by Rayzone Group and Mekorot, the National Water Company of Israel, have joined forces to safeguard water infrastructure from...

By Rayzone Group in collaboration with The Marker

February 28, 2024

A New Era in Border Control: AI-Driven Intelligence Solution for Smarter, Safer Borders

In a world increasingly interconnected, where more people are traveling to diverse destinations for various reasons, safeguarding borders has become...

By Orly Koren

November 9, 2023

Ransomware and Resilience: Protecting Critical Infrastructures in the Digital Age

In today's interconnected world, one of the areas that are particularly vulnerable to cyberattacks is critical infrastructure. Critical infrastructure refers...

By Orly Koren